The Flagship Investments Limited’s (FSI) portfolio closes out Calendar Year 2021 as it began- performing strongly, topping tables and delivering positive returns for shareholders. It achieves this through a disciplined investment process that produces a high conviction portfolio of quality-growth oriented companies.

The manager, EC Pohl & Co commenced 2021 managing $68.0 million in the portfolio and closed the year out managing nearly $93.5 million. This increase comes through a rise in the value of investments held and funds received through the issue of the Convertible Notes which trade on the ASX under the code FSIGA.

An article recently published on the FSI website explored the diversification benefit of investing in FSI as the underlying holdings were differentiated from other LICs, this article can be read here.

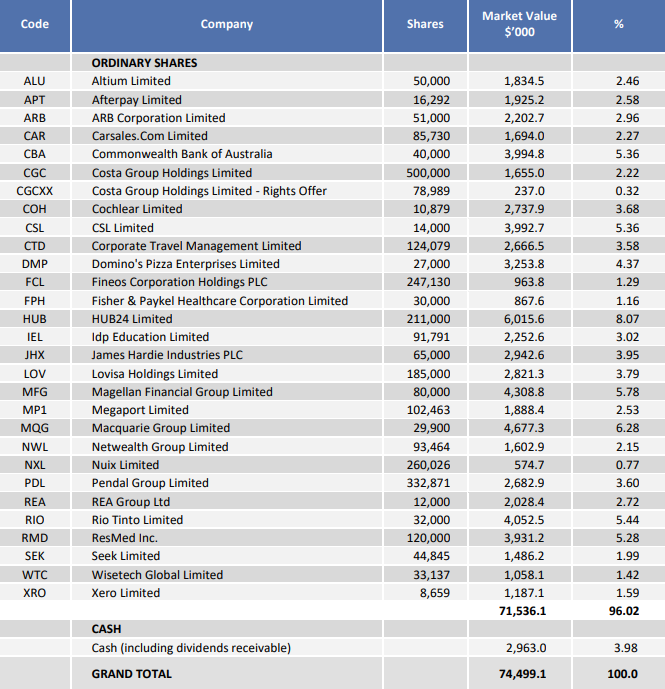

It also shows how many LIC’s hold similar sector weightings to one another, while FSI weightings are unique, demonstrating that the outperformance was generated by superior stock selection. The table below is from the 2021 FSI Annual report which lists all of the holdings in the portfolio as at 30 June 2021.

Table 2: Source Bell Potter

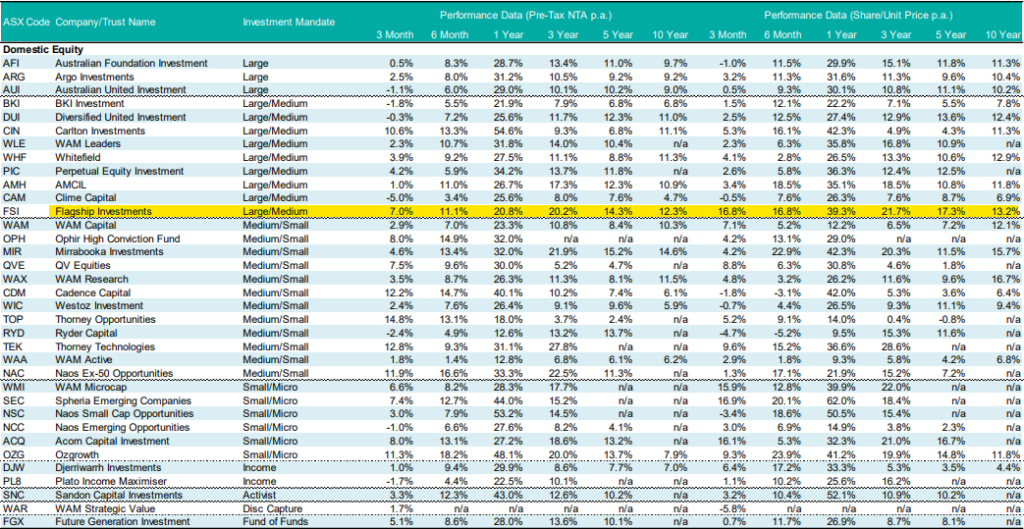

Our final table is produced by Bell Potter LIC research and is dated 10 December.

Flagship Investments Ltd performance closes out 2021 as the best amongst peer Large & Medium Cap investing LICs for 3 years pa, 5 years pa and 10 years pa. This is for both its NTA performance and Share price performance.

While we cannot predict how 2022 will fare and we must always acknowledge that past performance is no guarantee of future success, it is clear that the disciplined investment process of the manager identifies and constructs a portfolio of quality growth companies.

We thank our shareholders for their continued support in 2021 and look forward to continuing to grow shareholder wealth through 2022.